TL;DR

Google is the biggest company in the world and makes 90% of its money from online ads. Google’s ad revenues are based on commissions it receives from ad buys on its system. When an advertiser buys an ad impression from some site through Google, the publisher takes a cut and Google keeps the rest. Google ends up with more than half of the money in any case. Where the publisher in question is sending Google fake traffic or some other form of waste, Google makes exactly as much money from selling it as they do in the case of legit inventory. The magnitude and success of Google’s business are tied to selling more and more impressions that cost less and less money. This leaves Google in a very difficult situation; on one hand, it is under pressure to remain the largest company in the world, and on the other, it is making its money from an industry that has a serious problem with fraud to the extent that World Federation of Advertisers recently called it “endemic”.

“Just let it happen, the market will correct itself”

The story starts in 2004 when Google’s then CFO Reyes says “ad fraud is the biggest threat to internet economy” [1], a claim Google’s PR jumped promptly to correct.

Two years later Google settles out of a click fraud class action for $90 million [2]. The same year CEO Eric Schmidt says in a talk at Stanford University “letting it (fraud) happen is the perfect economic solution”[3].

Fast forward to today and we have researchers showing how Google charges for Youtube views even when they know its a bot [4] a story that landed on the cover of the Financial Times [5].

Another instance where traffic quality issues got Google on the headlines, is the story about a known and convicted terrorist funder who was using Google ads to make money with his propaganda site[6].

Advertising focused security firm Sentrant recently published research showcasing how Google Play was being used for very large scale fraud operation [7].

Working with Google as an ad fraud researcher

Through Botlab, the only research foundation focused on the malicious use of advertising technology, we have interacted with Google to some extent and have learned that when presented with information, Google reps are typically resorting to one of few options:

- refute the information by claiming the superiority of their people and the scale of their investment

- refute the information by making a specific counter claim, without being willing to discuss/debate the claim further

- not refuting the information but refusing to reveal any further intention or action associated with it

In the case of scientific research, the two first are clear fallacies. This can be verified from Wikipedia’s entry on Logic Fallacies[8].

Our working theory is that Google has a lot of good people, but also it’s the world’s largest corporations with tremendous financial market pressures to perform. They bought a lot of tech, like DoubleClick, a company that in 2003 was sued for showing computer error messages in place of banners [9], or blogger.com that at the time was very popular with “advanced SEOs” and “affiliate marketers”. I can’t find the source, but there was a German bank that did a paper where they analyzed blogger and found that 2/3 of the content was auto-generated. Those times it was all Markov auto-generated gibberish. Very cool tech, but does not read well.

Google has always been under a tremendous pressure to grow. To understand this, we can evidence how Google became the largest company in the world in a very competitive global market. Somewhere along the way, under all those pressures, some baggage in terms of traffic quality may have been acquired. I know all ad fraud researchers agree with the point about “Google being the largest single beneficiary of ad fraud” and it is a point very hard to debate. Because of its share in the total market, “just letting it happen” even to tiny extent amounts to billion of dollars of ad revenue. Stock market analysts don’t understand Google’s traffic issues, so the forecasts they make are completely ignoring the fact that at some point it needs to be “corrected”.

In short, summary, if Google in its current situation suddenly admit that 10% of their traffic is bad and probably has been bad all along, it could come at a catastrophic cost. This is one of the reasons why I’m wishing so dearly Google would be more eager to work closely together with researchers when they do reach out to them. There is ZERO benefit for having publicity on matters such as these. The preference of the ad fraud research community is to treat these in a similar way as vulnerabilities would typically be treated:

- researcher informs the company privately about the vulnerability

- the company has a window of time to take action before info is published

- the researcher makes the information public

In this process, there is no doubt, and everyone gets something valuable out of it. The issue with ad fraud related “vulnerabilities” is that the companies in question make money from letting them be.

How “cleaning up” looks like?

When AppNexus, one of Google’s competitors, started their fight for traffic quality, on the first move 65% of traffic footprint was lost [10]. Meaning that AppNexus at one go lost 2/3 of its immediate revenue potential, and opened the door for pissed off buyers who had been buying 2/3 garbage. When AppNexus made this move, Matomy, an Israeli ad network lost 1/3 of its market cap on the London Stock Exchange[11]. What AppNexus did in banking terms is same as bank admitting that it has many toxic assets on its books and that while it may seem fine and everyone is in on it, being part of increasing the risk associated with AppNexus significantly. In my view, this was the best thing to do in that situation. Now some other companies have already followed AppNexus’ example with similar initial results in terms of reduction to total traffic footprint. With the information I have, it seems unlikely that such an “initial push” would be less than 50% in the case of exchanges and ad networks (Google’s business models).

Is Google better off than AppNexus? Their starting point was better, but they have not made any “sudden” improvement like AppNexus and some other companies have. Because Google’s business is far bigger than AppNexus, and because it is a public company, we can conclude that Google has far more risk associated with doing something like this compared to AppNexus for example. I’m assuming that is a very difficult situation to manage even for the absolute best people in the world, which I’m sure Google employ many.

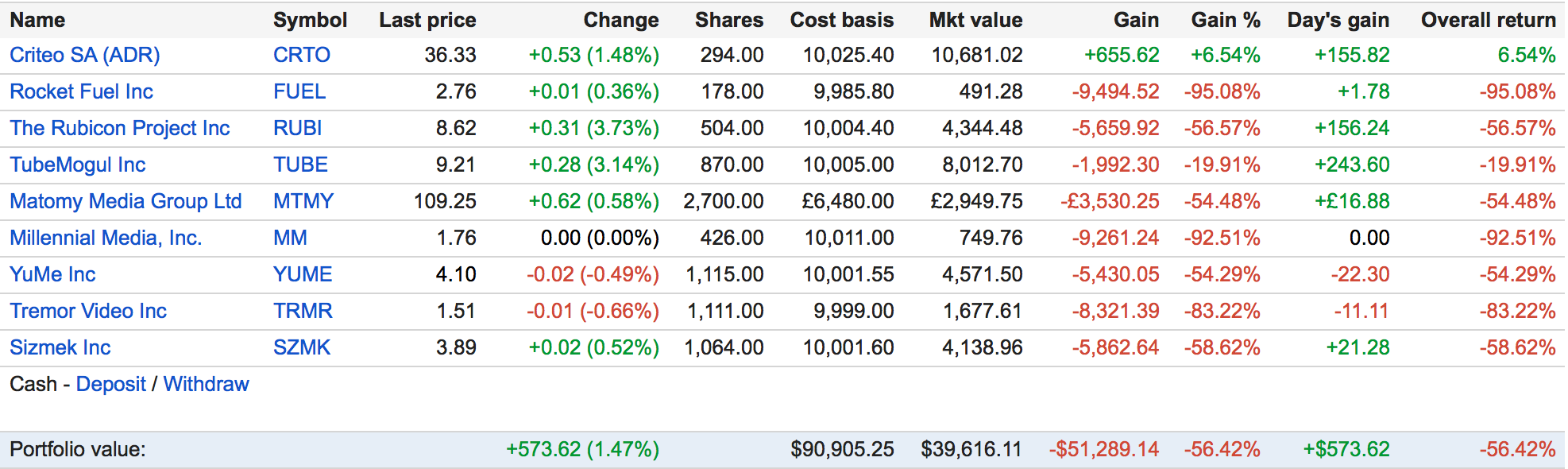

Out of the 10 or so listed adtech companies, others too have been rocked by ad fraud allegations. Rocket Fuel has lost 95% of its listing price a downturn it could not stop after being implicated in fraud allegations. At the same time, Google has increased its market cap many times the total market cap of all the other listed companies doing the same thing Google does.

After a long silence, past few months we saw how the financial analysts for the first time started to pay attention to the topic of how traffic quality issues may affect the stock price of Google [12]. Kalkis is recommending a correction to $200 per stock for Alphabet in relation to traffic quality issues.

Roughly $70 billion was invested on ads with Google last year. If even 10% of that goes to something that could be dealt with under the right circumstances, for example by being more transparent, then that means preventable losses of $7 billion in ad effectiveness. In product categories, e.g. cheap shampoo with a weak brand, easily more than half of the sales is a result of advertising. Because economies are increasingly dependent on consumer spending, weaker sales lead to fewer jobs, less tax money and other forms of tax payer burden.

Google’s problem seems to be that increasingly online advertising inventory is fraudulent, yet Google’s own revenues are almost entirely dependent on its ability to sell more and more online advertising inventory. The other problem is related to being the biggest in the world. Because Google has no other means for making tens of billions of dollars of revenue than online ads, Google wants online advertising market to expand, not shrink.

In comparison to ad networks in general, is Google bad? Definitely not. My understanding is that its traffic quality is above mid-tier in the market. For a company that grew so large so fast, some could argue that it is a feat in itself to do that and still end up mid-tier. The issue with comparing Google with other ad networks is that there are hundreds (if not thousands by now) of ad networks that 100% focused on arbitrage and nothing else.

Ari Paparo, who was the longtime product manager for Google DoubleClick both pre and post acquisition by Google, tweeted yesterday from dmexco:

“Talking to all the video arbitrage ad networks at #dmexco feels *exactly* like the scene in Big Short when Steve Carrell goes down to Florida”.

REFERENCES:

[1] Google CFO: Fraud a big threat

http://money.cnn.com/2004/12/02/technology/google_fraud/

[2] Google Agrees To $90 Million Settlement In Class Action Lawsuit Over Click Fraud

https://searchenginewatch.com/sew/news/2059444/google-agrees-to-usd90-million-settlement-in-class-action-lawsuit-over-click-fraud

[3] Google CEO on click fraud: ‘let it happen’ is perfect economic solution

http://www.zdnet.com/article/google-ceo-on-click-fraud-let-it-happen-is-perfect-economic-solution/

[4] Understanding the detection of fake view fraud in Video

http://www.recred.eu/sites/default/files/fake_views_imc15.pdf

[5] Google charges for YouTube ads even when viewed by robots

https://www.ft.com/content/53ac3fd0-604e-11e5-a28b-50226830d644

[6] Jihadi website with beheadings profited from Google ad platform

https://www.ft.com/content/b06d18c0-1bfb-11e6-8fa5-44094f6d9c46

[7] Fraud Through Comprised Apps and App SDKs Affecting Major Exchange

https://sentrant.com/2016/02/07/exposing-an-intricate-and-elaborate-scheme-of-mobile-ad-fraud-a-game-of-shells/